Lao Banking Industry Updated On Financial Regulations

Source: Vientiane Times

The Lao banking sector is working to improve regulations and update preparations for implementing the Basel II principles, including learning about the International Financial Reporting Standard (IFRS 9).

IFRS 9 is promulgated by the International Accounting Standards Board (IASB) and addresses accounting for financial instruments. It contains three main topics: classification and measurement of financial instruments, impairment of financial assets, and hedge accounting.

The Lao Bankers’ Association and Deloitte Consulting (Malaysia) yesterday co-hosted a meeting to review and update the revision of regulations in the local banking industry as part of strengthening capacity to implement the management of commercial banks based on the Basel principles by 2025.

Speaking at the meeting, Chairman of the Lao Bankers’ Association, Mr Phoukhong Chanthachack, said improving the management and services of commercial banks in Laos to comply with international standards is entirely obligatory.

“Upgrading the skills of all levels of banking personnel at commercial banks through intensive seminars and human resource development to build capacity for banking employees and to get preparations updated are additional steps to meet the recognised international standards,” he said.

He said that once a bank was recognised by the international community, it would build confidence among investors and enable the bank to approach bigger financial markets and expand services to integrate with global networks.

“Most importantly, the business sector, especially small and medium-sized enterprises will be better able to access funds,” Mr Phoukhong said.

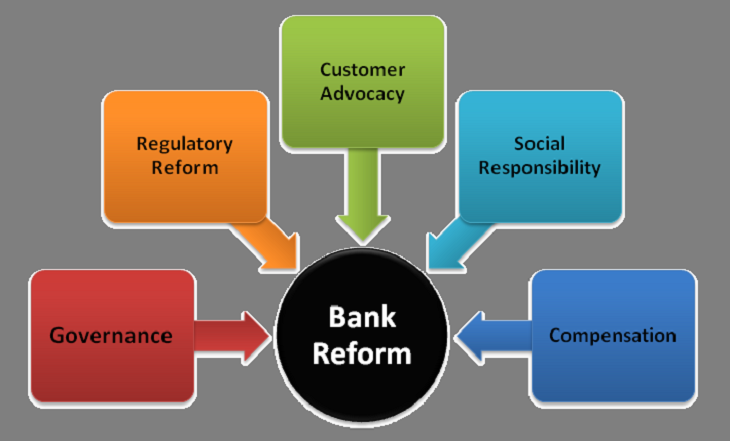

At the same time, a financial and regulatory risk advisor from Deloitte Consultant (Malaysia), Mr Justin Ong, was invited to share his experience in relation to corporate governance, risk appetite and risk assessment, and the Internal Capital Adequacy Assessment Process (ICAAP).

He also talked about financial risk management, Basel implementation and validation, Basel/ IFRS capital and risk modelling, ICAAP and capital management, financial instrument valuation and hedging, internal audit and regulatory compliance.

Meanwhile, the official in charge of preparing the Basel implementation at the Bank of the Lao PDR (BOL) gave a presentation on the improvements in legal processes to manage commercial banks in Laos and updating preparations for implementing the BOL 2016-25 strategic plan and vision for 2030 in managing commercial banks.

Established in 2001, the Lao Bankers’ Association became a member of the Asean Bankers’ Association in 2004. It works with local banks to support the growth of the nationwide economy.

It also represents the banking industry in Laos to attract investors and cooperates in financial services and technology development to promote financial services for trade and investment as well as implementing the framework for the Asean Economic Community.