Cancer Insurance – First In Laos !

Cancer – one of the most deadly diseases in the world today. Unfortunately, it is also one of the most expensive to treat and one that you are least prepared for. It can strike anyone at any time.

In Thailand alone every year more than 120,000 new cancer cases are diagnosed, with approximately 60,000 lives lost. The minimum cost of treatment for cancer is around 200,000 THB per person, which is a high number that not everyone is prepared for.

To counter these costs, you need a plan that can give you what other traditional health plans may not provide – a lump sum payout on detection plus cover of the treatment expenses.

J&C Insurance is proud to announce the launch of a unique product for the first time in Laos: APA Cancer Insurance! It is the perfect solution to secure your loved ones and yourself against cancer.

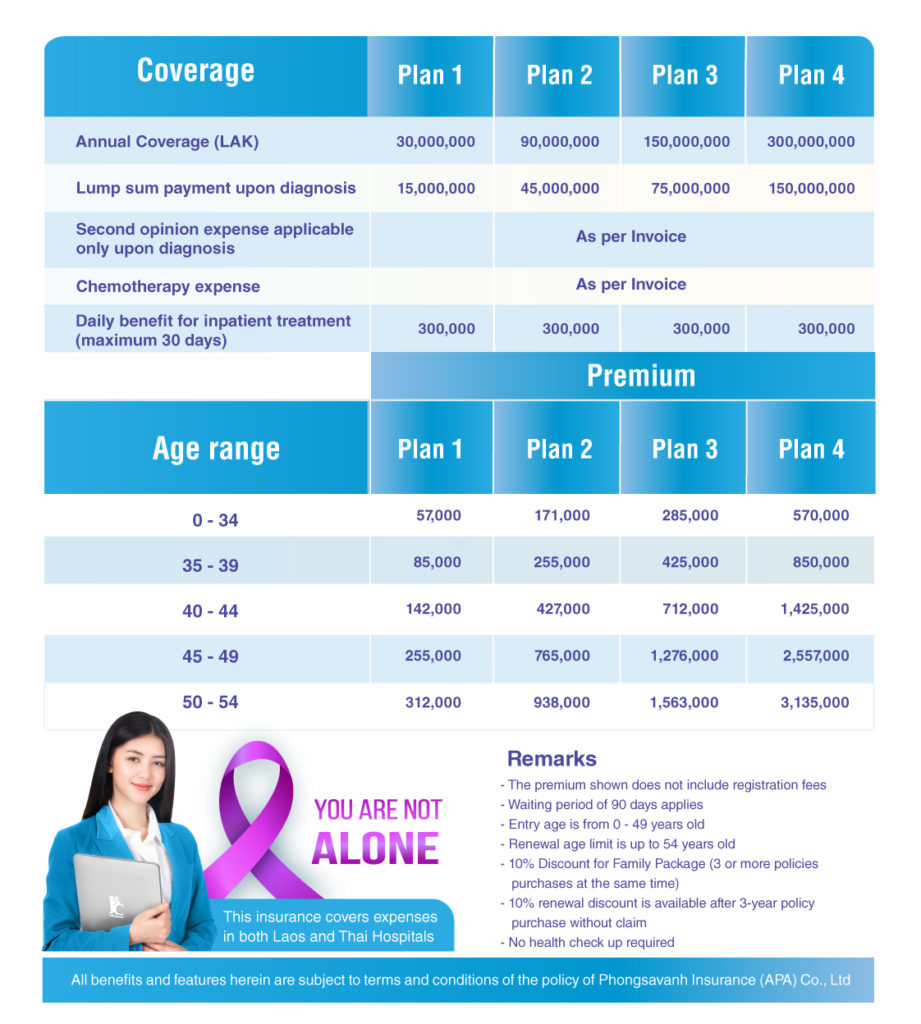

APA Cancer Insurance covers *:

• Lump sum payment upon cancer diagnose

• Second opinion expense when cancer is diagnosed

• Chemotherapy and Radiotherapy expenses

• Daily benefit for inpatient treatment

Download here:

– Brochure

– Policy wording

– Application form

Please send us the completed and signed application form with a copy of your ID/passport to insurance@jclao.com.

For more information contact us at insurance@jclao.com or 020 77 125 000 or ….

Get Your Cancer Insurance Quote Today !

[wpforms id=”19552″]

* SUMMARY PRODUCT DESCRIPTION AND INSURANCE BENEFITS

1. Product description

– Customers residing in Laos

– Minimum age: 0 years old; Maximum age: 49 years old (54 years old for renewal policy)

– Loss events: Confirmed first time diagnosis of cancer by a licensed medical practitioner including chemotherapy expense, and daily benefit for inpatient treatment following the first time diagnosis. Second opinion expense when the cancer is diagnosed as same as the confirmed first time diagnosis of cancer.

– Premium payment method: Annual

2. Definition of insured risks

a) Cancer

Definitions

Cancer is defined as a focal autonomous new growth of abnormal cells, which has resulted in the invasion of normal tissues. Such cancer must be positively diagnosed upon the basis of microscopic examinations of fixed tissues, or preparations from the haemic system. Such diagnosis shall be based solely on the accepted criteria of malignancy after a study of the histocytologic architecture or pattern of the suspect tumor, tissue or specimen. Clinical diagnosis, by itself, does not meet this standard.

Coverage

While this Policy is enforced, if the Insured is diagnosed for first time to be suffering from Cancer, according to the definition above, the Company shall provide benefits as stated in the Policy Schedule to the Insured Person.

The following are excluded:

- Prostate tumors classified as T1, papillary carcinoma of the thyroid less than 1 cm in diameter classified as T1N0M0 (TNM classification system); papillary micro-carcinoma of the bladder;

- Chronic lymphocytic leukemia less than RAI Stage 3;

- Tumors treated by endoscopic procedures alone; tumors classified as carcinoma in situ; tumors which pose no threat to life and for which no treatment is required. The diagnosis here must always be supported by histology reports;

- All types of skin cancers, except Malignant melanomas of 1.5mm or Malignant melanomas that is classified in stage 2 (stage 2) or more, based on the Melanoma distribution system of the American Joint Committee on Cancer;

- Borderline tumors of the ovary (also called tumors of low-malignant potential);

- Cervical dysplasia CIN-1, CIN-2 and CIN-3;

- Kaposi’s Sarcoma and other Tumors in the presence of HIV infection;

- Tumors that are a recurrence or metastasis of a tumor that first occurred prior to 90 days of the Effective Date.

Diagnostic criteria

a) Attending Physician Statement(s).

b) Histology/biopsy report(s)

b) Chemotherapy expense

Definition

Chemotherapy expense within this policy is defined as any expenses related to chemotherapy and radiotherapy that are necessary for the diagnosed cancer. Such treatment shall be done and approved by licensed physicians and/or licensed medical practitioners.

Coverage

While this Policy is enforced, if the Insured is diagnosed for first time to be suffering from Cancer and later on requires chemotherapy and/or radio therapy treatments. The Company shall provide benefits as stated in the Policy Schedule to the Insured Person.

c) Second opinion expense when cancer is diagnosed only

Definition

Second opinion expense within this policy is defined as any expenses related to any medical treatment and/or examination that are necessary for the diagnosed cancer for the second time. Such treatment shall be done and approved by licensed physicians and/or licensed medical practitioners.

Coverage

While this Policy is enforced, if the Insured is diagnosed for first time to be suffering from Cancer and later on seeks for second opinion from different licensed medical practitioner. The Company shall provide benefits as stated in the Policy Schedule to the Insured Person. The Company shall only pay the benefit if the diagnosis of the second opinion is the same as the first time diagnosis of the same cancer.

d) Daily benefit for inpatient treatment

Definition

Inpatient within this policy is defined as a person who is hospitalized for over six consecutive hours.

Coverage

While this Policy is enforced, if the Insured is diagnosed for first time to be suffering from Cancer. When inpatient treatment in necessary, the Company shall provide benefits as stated in the Policy Schedule to the Insured Person. The Company shall only pay if the treatment is done and approved by licensed physicians and/or licensed medical practitioners.

All benefits and features herein are subject to terms and conditions of the policy of Phongsavanh Insurance (APA) Co. Ltd. Download the policy wording here.

For more information contact us at insurance@jclao.com or 020 77 125 000