Foreigners To Pay More Income Tax

It was Benjamin Franklin who said that nothing is certain in life except death and taxes. He certainly wasn’t wrong, even here in Laos. A new law is set to increase taxes paid by foreigners from the current flat rate of 10% to up to 28%. Tax paying organisations with a large amount of foreign workers are in for a rough ride.

The presidential decree regarding tax which has now been passed was dated 01 March 2011 and amends the existing tax rates of Profit Tax, Business Turnover Tax and Personal Income Tax. Under the new decree, Lao and foreigners are now taxed at the same rate, with the effect that Lao employees will pay less and the foreign employees more than before. The decree stipulates the following changes:

Business Turnover Tax (BTT):

The rate of 5% will be abolished; therefore supplies currently at 5% will become taxable at the 10% rate.

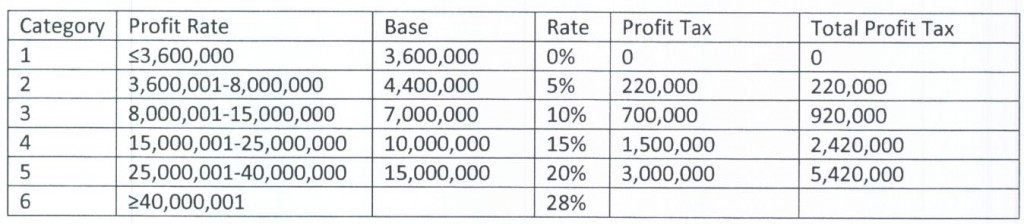

Profit Tax:

The standard rate of profit tax for both foreign and domestic invested companies will be reduced from 35% to 28%. Companies engaged in the manufacture of tobacco products will pay a rate of 30%, of which 2% will be contributed to a tobacco control fund.

The revised profit tax rates for Sole trader enterprises and freelancers which pay tax based on the basic accounting system is as follows:

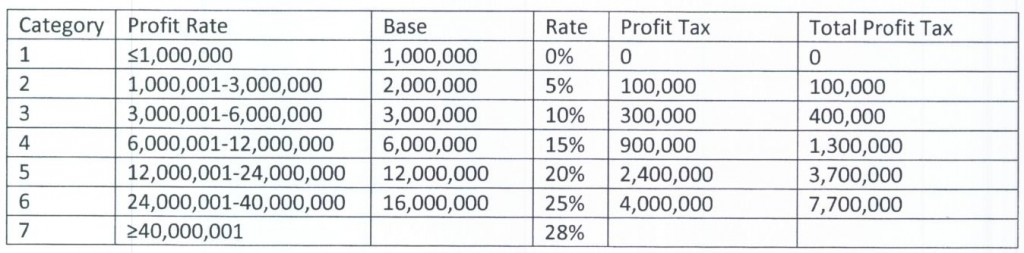

Personal Income Tax (PIT):

The new personal income tax rates applicable to Lao, foreigners, aliens and apatrids who generate income in Lao PDR is based on a progressive rate from 0% to 28%, as per the following table:

Employees with salaries of 1 million kip or less per month will be exempt from income tax. At present, only those earning 300,000 kip or less per month are exempt.

The decree was to be effected from January this year, but according to the Ministry of Finance, it will come into effect next fiscal year because the decree was only approved in March and not backdated. In Laos, the fiscal year begins on 1st October.

Source: DFDL Mekong, Vientiane Times & Presidential Decree dated 1.3.2011